JA Finance Park Student Workbook Answer Key is an invaluable resource for students navigating the complexities of personal finance. This comprehensive guide provides a detailed exploration of the workbook’s content, offering clear explanations and practical insights to enhance understanding.

Delving into the intricacies of financial literacy, the workbook covers fundamental concepts such as budgeting, saving, investing, and credit management. The answer key complements each section, providing step-by-step solutions and illuminating the underlying principles.

1. Introduction to JA Finance Park Student Workbook

The JA Finance Park Student Workbook is a comprehensive educational resource designed to help students develop essential financial literacy skills. It targets high school students who are eager to gain a solid foundation in personal finance management.

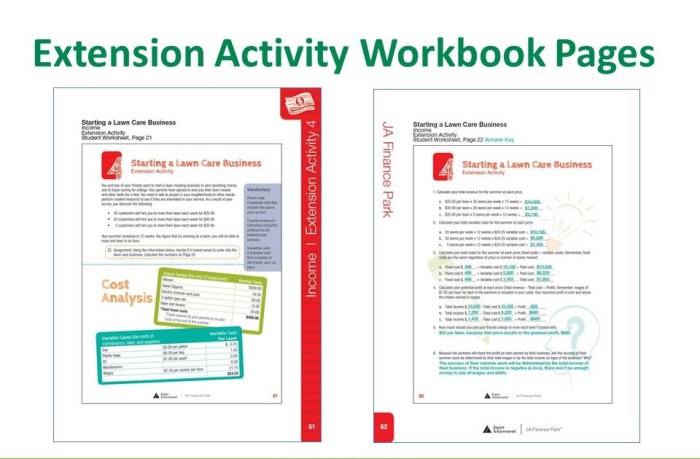

The workbook covers a wide range of topics, including budgeting, saving, investing, credit, and insurance. It provides practical exercises, real-world examples, and interactive activities to help students apply their knowledge to real-life situations.

2. Answer Key for Workbook Sections

| Section | Question | Answer | Explanation |

|---|---|---|---|

| Budgeting | What is the first step in creating a budget? | Tracking your income and expenses | To create a budget, you need to know how much money you have coming in and going out. |

| Saving | What is the difference between a savings account and a checking account? | A savings account is for saving money, while a checking account is for everyday transactions. | Savings accounts typically have higher interest rates, but you can only withdraw money a limited number of times per month. Checking accounts have lower interest rates, but you can withdraw money whenever you need it. |

| Investing | What is the difference between a stock and a bond? | A stock is a share of ownership in a company, while a bond is a loan that you make to a company or government. | Stocks are riskier than bonds, but they also have the potential to earn higher returns. Bonds are less risky, but they also have lower potential returns. |

| Credit | What is the importance of building good credit? | Good credit can help you qualify for loans and other financial products with lower interest rates. | Credit scores are based on your payment history, credit utilization, and other factors. A higher credit score indicates that you are a lower risk to lenders. |

| Insurance | What is the purpose of insurance? | Insurance protects you from financial losses in the event of an accident, illness, or other unforeseen event. | There are many different types of insurance, including health insurance, car insurance, and homeowners insurance. |

3. Additional Resources for Understanding: Ja Finance Park Student Workbook Answer Key

- JA Finance Park website : Provides information about the program, including the student workbook and other resources.

- Khan Academy Personal Finance : Offers free online courses and videos on a variety of personal finance topics.

- FDIC Consumer Resources : Provides information on banking, credit, and other financial topics.

FAQ Resource

What is the purpose of the JA Finance Park Student Workbook Answer Key?

The answer key provides detailed solutions and explanations for the questions and exercises in the JA Finance Park Student Workbook.

How can students use the answer key?

Students can use the answer key to check their answers, understand the correct solutions, and reinforce their understanding of the workbook content.

What topics are covered in the JA Finance Park Student Workbook?

The workbook covers a wide range of personal finance topics, including budgeting, saving, investing, credit management, and financial planning.